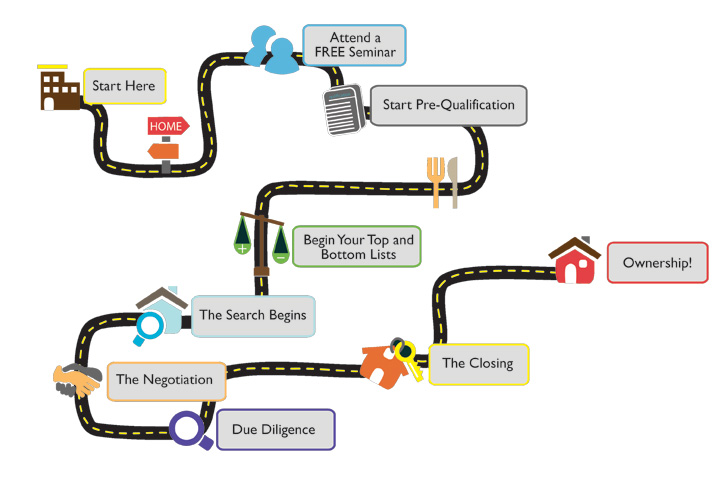

Welcome to the Buyers Road Map!

Please follow the road to get to the destination that you desire.

If you’ve attended a first time homebuyer seminar, the one thing that should’ve stuck with you more than anything is to talk with a lender ASAP. Even if you’re not looking to buy for the next twelve months, do it now. Talking to a lender early in the process makes life so much easier down the road. Why? It’s all about preparation. In order to get the best overall deal on a home, you must also get the best overall interest rate / minimal lenders cost as possible. Finding out your credit situation, what type of payment your qualified for, and what monthly payment you’re comfortable with is VITAL to this whole process. If something needs to be adjusted, like your credit report for instance, early is better.

Click here to view or download a sample credit report.

How long does it take? There are two ways to get pre-approved (“pre-approval” and “pre-qualification” reference two different documents that represent two different stages of the mortgage approval process, to most lenders). The first is where a lender will run your credit and have a discussion with you regarding how much money you make, how long you’ve been employed, as well as a few other questions depending on your credit situation. With the credit report in hand and knowing your income, the loan officer will calculate your debt-to-income ratio. With your credit score, debt-to-income ratio, and employment history, your loan officer will be able to determine whether you COULD be qualified to buy a home and at what price (including taxes, monthly assessments, and private mortgage insurance). This interview will take around 20 minutes and as long as you submitted accurate information, some lenders will pre-approve you at that time.

The second way to get pre-approved is to have this discussion AND bring in all the documents required to obtain an actual loan. These items will include tax returns, W2’s, bank statements, and other items depending on your situation. Although this takes longer, this is the better route. Your loan officer will have all the DOCUMENTED information they need to pre-approve you. Now you have, what StartingPoint Realty calls, a full documented pre-approval. Some lenders will take these documents and bring them in front of an actual underwriter. That’s even better, but that could take over a week.

Which method is better for you? If you’re over 8 months away from purchasing, the 20 minute phone call is a good starting point (pardon the pun) for you. Here it becomes more of a consultation to get you ready in order to obtain a documented pre-approval. For those that are within a few months of purchasing, take the time to bring in all your documents to a loan officer. You’ll have to do it at some point, you might as well get it done sooner than later.

#1. Where will you live? We mentioned this in the Top & Bottom Lists. Some know this right away, some have no idea. Take your time with this decision. City vs. Suburbs? Close to Metra? If suburbs, is a downtown area important? A good agent will ask the right questions to get you thinking.

#2. Listings. You will be looking online yourself, but if you’ve chosen a real estate agent by now, you should be receiving emailed listings from your agent by this time. Start picking properties out. If you’re using StartingPoint Realty (we can’t speak for other agencies), we give you as much control as you want. If you want to select all the listings to see, go for it. If you want to select most of the listings, but you also want us to throw in a few that we think you’d like, we can do that to. If you want us to pick everything out (rarely happens), let us know. We tailor the search part to your preferences. Your agent will schedule all the showings, and be with you at each place you see.

#3. Take your time and be prepared to walk away. After the initial feel of the place, make sure you’re also looking at the furnace, roof, siding, basement walls, age of appliances, water heater, etc. You should be excited when you find the ‘one’, but you must also understand that this is a business decision. You have to know what the home is going to cost you down the road. If you’re looking at a townhome / condo, you and your agent have some research to do on the financials of the home owners association.